If you’re searching gomyfinance.com credit score, you’re probably chasing a clean explanation of what a credit score is, how it’s calculated, and which moves raise it without wrecking your monthly budget. This guide translates finance into gamer logic—systems, stats, cooldowns, and win conditions—so you can make smarter choices fast. We’ll weave in practical phrases like FICO, VantageScore, payment history, credit utilization, hard inquiry, credit mix, average age of accounts, and dispute errors, and we’ll bold those keywords where it helps scanning. You’ll also find two quick reset links to OviGames titles that help you take a breath between money decisions—because tilted choices cost points in games and credit alike.

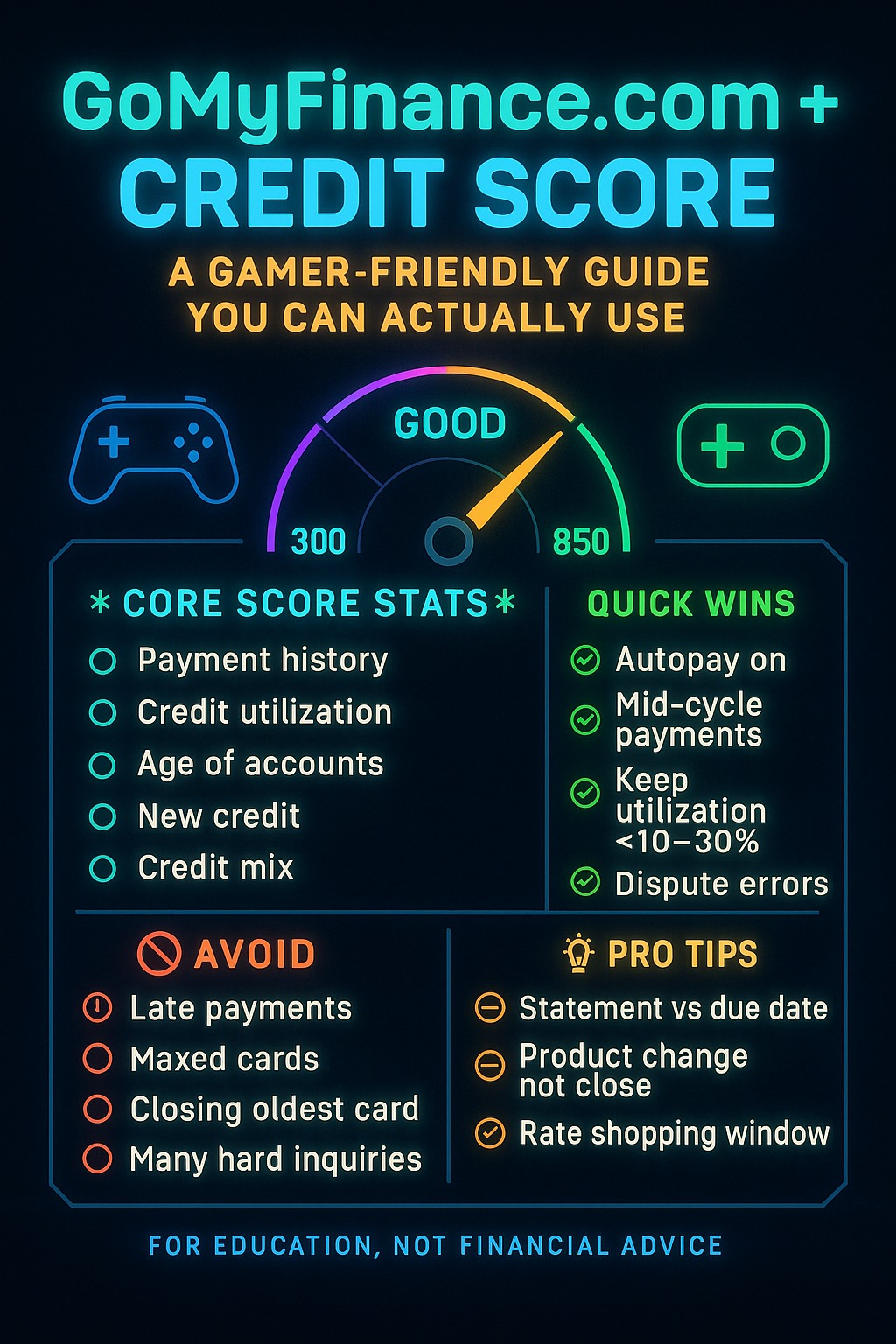

At its core, a credit score is a risk signal: a three-digit number that estimates how likely you are to pay lenders on time. The two most common scoring models are FICO and VantageScore; both look at your payment history, amounts owed/credit utilization, length of credit history (average age of accounts), new credit (hard inquiries and recently opened tradelines), and credit mix (installment + revolving). Exact weightings differ by model and version, but one rule never changes: on-time payments plus low credit utilization dominate the score. Think of it like a game where 100% on-time is your S-tier mechanic and utilization under 10% is your go-to buff.

While ranges vary slightly, most charts look like this: 300–579 poor, 580–669 fair, 670–739 good, 740–799 very good, 800–850 exceptional. Remember: lenders don’t price loans off a single universal number; they price off the model and version they use (e.g., FICO 8, FICO 10, VantageScore 4.0). Two scores can coexist, so don’t panic if your VantageScore and FICO aren’t twins—focus on the behaviors both reward.

Payment history (your hit rate). Even one late payment can tank a score; a 30-day delinquency hurts less than 60/90, but all are avoidable with autopay and alerts. 2) Credit utilization (balance ÷ limit). Keep each card and your overall usage under 10% if you can; under 30% is a baseline. Utilization is scored at statement cutoff—not just due date—so mid-cycle payments can lower reported balances. 3) Average age of accounts. New cards are great tools, but every fresh line thins your history. Open strategically; don’t churn without a plan. 4) New credit. Each hard inquiry can shave a few points for ~12 months; rate-shopping for auto/mortgage within a tight window is usually deduped as one inquiry. 5) Credit mix. A healthy blend of revolving (cards) and installment (loans) helps, but never open debt just to “diversify.”

A soft pull (pre-qualification, monitoring) doesn’t affect your score. A hard inquiry (final application) does—temporarily. Apply when the odds are strong: use pre-qualification with real rate ranges, check issuer rules, and avoid stacking multiple card apps over a weekend unless you’re executing a deliberate strategy.

• 90-Day Plan: Turn on autopay for at least the minimum due on every account; add calendar reminders three days before statement cutoffs; pay balances mid-cycle to keep credit utilization low when it reports. If your file is thin, consider a secured card or credit builder loan. • 180-Day Plan: If trusted family can add you as an authorized user to a long, clean card with low utilization, you can inherit positive history (no late marks). Keep building your own tradelines too; an AU slot isn’t a substitute for primary credit. • 12-Month Plan: Avoid closing your oldest card (protects average age of accounts). If a card’s fee annoys you, product change to a no-fee variant instead of closing it.

• Statement vs. due date: Issuers snapshot your balance at statement close; that number becomes the reported utilization. Make a small pre-statement payment if you’ve spent more than 10–30% of your limit. • Multiple cards help distribution: two cards at 10% each is often better than one card at 60%. • 0% APR promos aren’t score boosters if they lead to high utilization; a $0 interest balance can still ding your score if it’s 70% of your limit. • Balance transfers lower APR, but watch transfer fees and avoid maxing the new line—again, utilization matters.

• Late payment (30/60/90 days). A single 30-day late can set you back for years; call the issuer immediately if you slip—many offer one-time courtesy removals for long-time on-time customers. • Closing your oldest line without a plan (shrinks average age). Consider product change instead. • Maxed cards (90–100% utilization); even if you’re “paying it off next week,” the reporting day may catch you. • Opening too many lines at once (clustered hard inquiries plus thinner age).

Pull reports from the major bureaus and look for mixed files, duplicate collections, or paid debts still listed as open. Use bureau portals to dispute errors and attach receipts; keep tone factual and include dates. If you suspect fraud, place a fraud alert or a credit freeze (unfreezing is trivial and free in most jurisdictions). Fraud control is like toggling friendly fire off; there’s no reason to run without it.

Traditional installment loans (auto, student, mortgage) can help credit mix as long as you pay on time and keep DTI (debt-to-income) reasonable. BNPL is trickier: reporting isn’t uniform, and missed payments can emerge as collections. Treat BNPL like a loan with consequences, not a free power-up.

A high credit score opens doors, but lenders also look at DTI, income stability, and the specific APR they can offer you. Chasing 800+ is fine, but getting from 680 → 740 often unlocks far more savings than grinding 820 → 830. Your goal is score + affordability—a clean build that wins approvals and fair pricing.

• Myth: Checking my own score hurts it. Reality: A self-check is a soft pull; it doesn’t impact your score. • Myth: Carrying a balance improves my score. Reality: Balances can create utilization drag and interest; you don’t need to pay interest to score points. • Myth: Closing a paid card always helps. Reality: It can hurt average age and reduce available limit, raising utilization. • Myth: Paying a collection deletes it. Reality: It may update to paid, which is better, but not vanish unless the collector agrees to pay-for-delete per policy.

Day 1: Turn on autopay (at least minimum due) for every card; set two reminders—three days pre-statement, three days pre-due.

Days 2–7: Pay balances to push utilization under 10–30% on each card; schedule a mid-cycle payment.

Week 2: Pull your reports and dispute errors with documentation; consider a credit freeze to block new-account fraud.

Week 3: If your file is thin, add a secured card or credit builder loan (low fee, no junk add-ons).

Week 4: If available and appropriate, become an authorized user on a long, spotless card (low utilization).

Month 2: Avoid new hard inquiries unless the approval odds are excellent; don’t close your oldest account.

Month 3: Re-check utilization on statement day; if needed, split spending across cards to keep each low. Keep going—scores compound like skill.

• Banking app with alerts for statement and due date. • A score-tracking app (understand it’s often VantageScore; trends matter more than the exact number). • Spreadsheet or note with each limit, typical statement date, and target utilization. • Issuer chat/secure messages for product change requests and late-fee waivers (if something slips once).

If you’re underwater, prioritize: 1) secure housing and utilities, 2) minimum due on every card to protect payment history, 3) highest APR next. Call issuers to request hardship options (temporary rate reductions, payment plans). Document every call. One controlled stumble beats a chaotic fall.

Treat your credit score like an evolving loadout: on-time payments are your passive perk, utilization under 10% is your aura, and dispute errors is your cleanse. Check in weekly, not hourly. Score changes have lag—no need to spam F5.

If you’re browsing gomyfinance.com credit score articles, skim for clear definitions (what FICO vs VantageScore means), practical steps (how to lower credit utilization mid-cycle), and transparent disclaimers (educational, not personal advice). Articles that separate soft pull from hard inquiry, explain rate-shopping, and demystify authorized user strategy are keepers. Use those insights, then verify specifics with your issuers and country rules.

Q: How fast can I go from 580 to 680? A: It depends on late payment history and utilization. Lowering utilization and restoring on-time streaks can move scores within a couple of cycles; derogatories take longer.

Q: Should I pay before the due date or the statement date? A: Both can help—paying before statement lowers reported utilization; paying by due date prevents interest and keeps payment history perfect.

Q: Do I need multiple cards to hit 700+? A: Not strictly, but 2–3 well-managed lines make utilization easier and build credit mix.

Q: Will closing a new card I don’t like help? A: Probably not. If fees bug you, product change instead of closing; protect your average age.

Q: Is 0% APR dangerous? A: Not if you pay on time and keep utilization low. Don’t let the 0% label tempt you into maxing a limit.

If a debt has become a collection, paying it is better than letting it rot, but ask the collector about pay-for-delete policies first (not all permit it). Get everything in writing. Once paid, monitor to make sure the status updates. For charge-offs, the balance may still show until resolved; negotiate respectfully, aim for closure, and track the reporting timelines in your region.

Rules differ by country—reporting windows, dispute timelines, and even which bureaus exist. The behaviors that help everywhere remain the same: on-time payments, low utilization, stable average age, limited hard inquiries, and prompt dispute errors. Always cross-check any tactic with your local regulations and lenders’ written policies.

When your brain needs a cooldown between credit tasks, try two quick in-browser games that won’t repeat titles we’ve linked in other posts: clear your head with the arcade-speed Pretty Sheep Run and then zone into rhythm and timing with Helix Jump. A five-minute reset now = fewer tilt decisions later.

Automate minimum due; pay mid-cycle to keep credit utilization low. 2) Guard payment history like your main quest; set redundant alerts. 3) Open new accounts only with strong approval odds; respect hard inquiry cooldowns. 4) Protect average age of accounts—prefer product change over closure. 5) Pull reports quarterly; dispute errors and lock down with a credit freeze if needed. 6) Remember the boss rule: you don’t need perfection to win—consistent S-tier habits beat once-a-year heroic plays. Follow this loop and the three digits will handle themselves while you focus on bigger goals—better APRs, lower stress, and more time for actual fun on OviGames.