If you’ve been searching fintechzoom com lately, you’ve probably seen multiple look-alike properties promising market news, stocks, crypto tools, and real-time data. Think of FintechZoom as a brand family that publishes financial news and research across sites and social channels. In practice, you’ll encounter domains like fintechzoom.io (research/tools positioning) and social feeds (X/TradingView) describing coverage of stocks, indices, crypto, loans, and mortgages. Treat it like a hub for market explainers and signals, then verify which domain you’re actually on before acting.

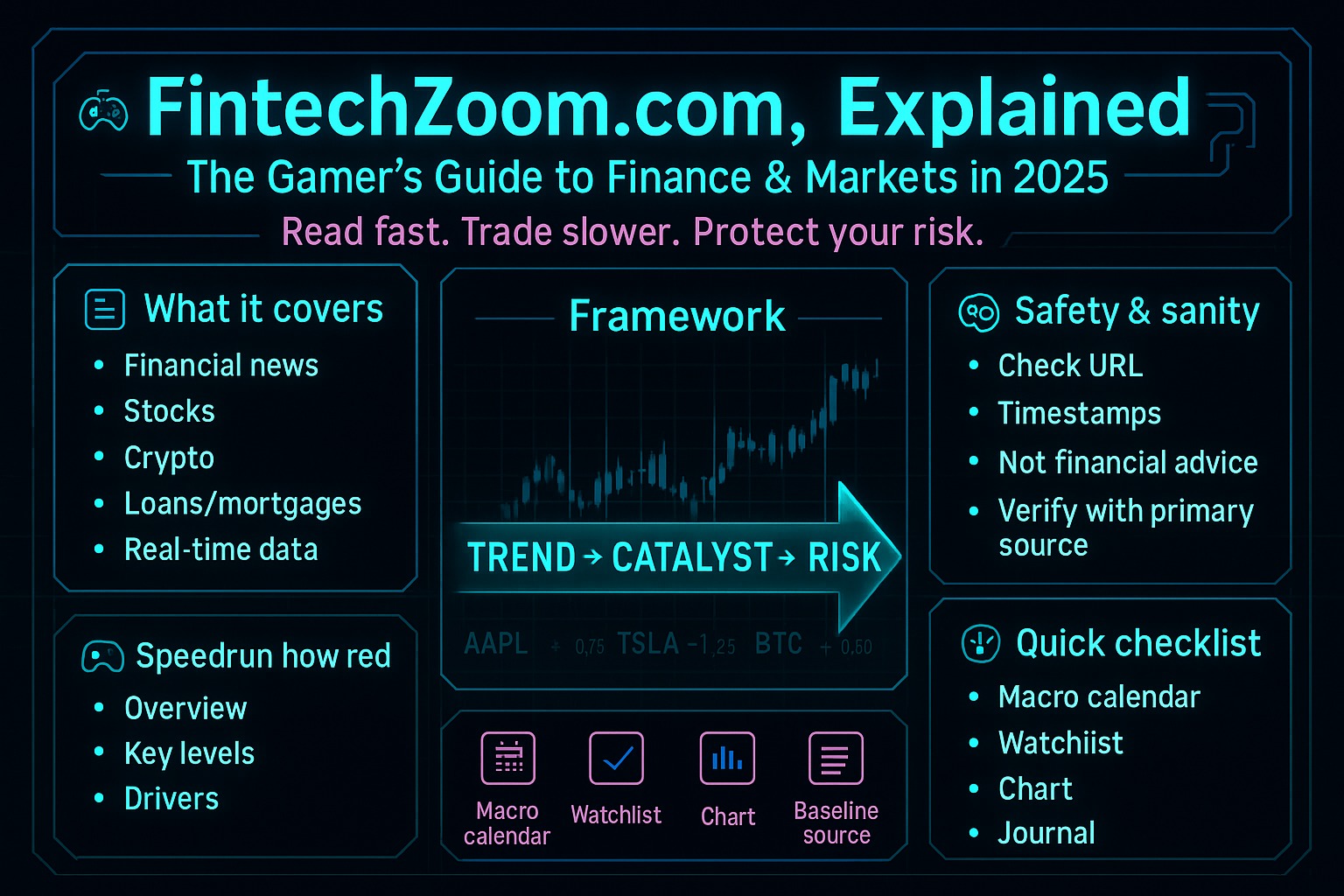

Across explainer posts and platform guides, FintechZoom is framed as a financial technology and markets outlet: stock analysis, crypto updates, economy, mortgages/loans, and how-to items that help beginners track price action and macro signals. If you see a “Markets” or “Crypto” section, expect ticker pages, roundups, and entries like “Tesla/Apple stock,” “Bitcoin price,” or “Dow/Nasdaq today.” Your move: skim headlines, then jump to sections labeled overview, key levels, drivers, and outlook. This saves time and gets you from “wall of text” to “do I need to act?” in under a minute.

The FintechZoom name appears on more than one property (e.g., fintechzoom.io, fintechzoom.ca) and is also discussed in third-party guides and roundups. That’s normal in 2025, but it means you should check URL spelling, About/Contact pages, and the tone of the site before you trust tools or sign up for anything. When an article claims real-time data or AI insights, confirm whether you’re on an official content site, a news mirror, or a review explaining the brand. The legit social bios help triangulate scope (markets, stocks, crypto).

Use gamer logic: read objectives, then mechanics. In a stock piece, scan for catalysts (earnings, guidance, macro prints), levels (support/resistance), and timeframe (intraday vs. long-term). In a crypto post, look for volatility regimes, funding/open interest context, and narrative (ETF flows, regulation). Many third-party explainers position FintechZoom’s pitch as analysis + real-time data + beginner guides; adopt a filter: what’s education, what’s opinion, what’s tooling?

Pane 1 — Trend: What is the higher-timeframe direction in the chart (uptrend/sideways/down)? Pane 2 — Catalyst: What events are near (earnings, CPI, rate decision) and how might they move implied volatility? Pane 3 — Risk: What’s your invalidating level and position size? Every FintechZoom-branded breakdown (or roundup about it) makes more sense inside this triad—no indicator soup, just trend → catalyst → risk.

Markets/Home: a river of top stories and ticker explainers. Use it to fill your watchlist and pick what’s worth deeper study. Crypto: focus on dominance shifts, ETF flows, and structural themes (L2s, rollups, staking). Guides: bite-size explainers (e.g., what is short interest, how earnings work). Lifestyle/Money Tips: useful for budgeting mindshare, but treat these as general education, not personal advice. Third-party roundups consistently describe FintechZoom in these buckets; verify the current site’s menu and timestamps.

Scan the byline (author vs. “staff”), publish date, and the presence of tickers/charts. If the page invites you to “connect API keys,” that’s a tool (extra caution). If it aggregates other outlets with minimal added analysis, it’s curation. If it lays out levels, scenarios, and caveats, you’re in analysis. Cross-reference claims with a mainstream finance baseline when needed.

Signal: macro prints (CPI, NFP), earnings, guidance, flows, breadth, and positioning. Noise: one-off tweets, unlabeled screenshots of “indicators,” and price targets with no thesis. FintechZoom-style “what to watch” posts are helpful when they separate the two and time-box the horizon (“this week,” “this quarter,” “cycle-aware”). Use the framework; ignore the dopamine traps.

Context: macro state + sector map. 2) Setup: why this ticker/coin now. 3) Levels: support/resistance, invalidation, potential ranges. 4) Catalysts: earnings, guidance, macro calendar. 5) Risks: what breaks the idea. 6) Scenarios: bull, base, bear. When a page follows this structure, you can act (or choose not to) without guesswork. Several third-party explainers describe FintechZoom content in exactly this “analysis + tooling” blend.

• This is education: even detailed FintechZoom-branded notes are not personal financial advice. • Position sizing > precision. • Leverage amplifies mistakes—paper-trade any new idea first. • Diversify your research feeds: compare a FintechZoom article with one mainstream finance baseline and one primary source (company filing, protocol docs).

Because the ecosystem uses multiple domains and social handles, build a quick checklist: URL spelling (watch for look-alikes), About/Contact visibility, consistent branding across X/TradingView, and recent timestamps on articles. If a page promises “invest with our signals” yet doesn’t match the social bios (which usually list markets, stocks, Nasdaq/Dow, crypto, banking), pause and validate.

Economic calendar (know when the alarm will ring) • a watchlist (tickers/coins) • a clean price chart (no more than 2 indicators) • a journal (thesis, entry, invalidation, outcome) • a baseline source (e.g., mainstream finance page) to cross-check headlines. Anchoring to a baseline prevents narrative drift.

Suppose you read a “Bitcoin today” roundup that cites ETF flows, macro, and levels. Your steps: 1) tag the timeframe (are we talking day-trade or swing?). 2) mark levels on your own chart. 3) write a one-line thesis (“above X with rising breadth, I hold; below Y, I step aside”). 4) pre-define risk (size so a normal wick doesn’t liquidate you). Third-party content describing FintechZoom’s crypto coverage frames it as a useful primer; you still control execution.

Recent guides cast FintechZoom as a news/education platform with stock and crypto angles, often highlighting real-time dashboards or AI-assisted pitches. Treat those claims as a starting point; confirm features against the specific domain you’re on, since naming collisions exist. This helps you avoid phishing look-alikes and SEO mirrors.

If you’re a streamer or guide-writer, FintechZoom-style posts can seed your daily brief: pull three headlines, map two levels per asset, and frame one catalyst for the session. Cite sources, add your own risk framework, and you’ll ship content that respects viewers’ time. Bonus: pairing a more formal brief with a casual “what changed in the last 24h” segment hits both beginners and regulars.

Use FintechZoom’s educational pieces to refine asset selection and rebalancing rather than chase a number. Whether you prefer dividends, growth, or indexing, your real job is to keep drawdowns survivable and behavior consistent. Build a ruleset: position size caps, time-based review, and pre-committed responses to macro surprises.

Myth: “One ‘insight’ page guarantees outperformance.” Reality: process beats one-offs; treat articles as training data. Myth: “If it’s labeled FintechZoom, it’s one company everywhere.” Reality: the name appears across multiple properties and channels; always verify where you are. Myth: “Real-time” means “risk-free.” Reality: speed ≠ certainty; risk management is the only durable edge.

Check macro calendar (what could move price). 2) Skim Markets/Crypto headlines; star 3 items. 3) Mark levels on your chart; hide extra indicators. 4) Write a one-line thesis per asset. 5) Define invalidation and size. 6) Set two alerts; close the tab. 7) Review outcomes at day end; journal one lesson. This loop turns reading into skill.

FintechZoom content you read on any domain (or summarized by third parties) is typically educational; it’s on you to check broker/platform rules, tax, and regional restrictions before acting. When an article discusses loans/mortgages or insurance, treat it as a concept primer and verify product details with providers. External reviews explicitly pitch FintechZoom as information rather than an execution venue—use that expectation to avoid missteps.

Decision-making improves when you take short breaks. Try two quick, no-install games we haven’t linked in our other Fintech posts here: 3D Jigsaw Puzzle for a calm, spatial-reasoning reset, and Line Puzzle 3D to sharpen sequencing and planning. Five minutes each is enough to return with a cooler head.

• URL sanity: spelling, HTTPS, About/Contact • Timestamp: is it recent? • Scope: education vs. tool vs. news • Claims: are drivers/levels listed, or just adjectives? • Cross-check: glance at a mainstream finance baseline • Action: if you can’t state your thesis + invalidation in one line, you don’t have a trade—yet.

The FintechZoom universe is best used as a learning accelerator and idea finder—not a crystal ball. Keep trend → catalyst → risk as your lens, verify the domain, and protect your focus with short breaks. Do that and you’ll turn market noise into signal—while keeping your gameplay (and your portfolio) fun, deliberate, and alive for the next level.